Do you want to sell your house but owe more than the house is worth? Can’t afford your house payments? Need to sell, but afraid you won’t have enough money to buy your next house? Looking for options for selling your home at a loss? If you have looked at other programs like Making Home Affordable but without any success, it may be time to consider a short sale.

Short selling your current home and buying another one seems impossible, right?

Actually, it’s not. And in this article I’ll give you the keys to doing a successful short sale and still buying another home.

Many homes still seriously under water

While many people have forgotten the financial crisis of 2008, others continue to struggle financially. A recent study by Zillow showed 4.5 million homeowners do not have enough equity to sell their home and buyer another. In the Sacramento region, there are still several thousand homes that are underwater. As of Q2 2018 in Roseville alone, 835 or 7.9% of the mortgages were seriously under water according to Atom data.

Benefits of a short sale

There are several benefits to doing a short sale over losing your home to foreclosure.

Avoid the negative impact of a foreclosure

A foreclosure can impact your life for years to come. A foreclosure stays on your credit report for 7 years increasing your for future loans. Even on future home loan applications, you will be asked if you have ever been foreclosed, even after 7 years. Furthermore, a foreclosure can cause your credit score to drop by 85 to 160 points. To add insult to injury, future home loans may cost you an additional one to two percent more in your annual interest rate.

It not only ruins your credit, but affects you emotionally and can leave you feeling embarrassed. Pursuing a short sale allows you to gracefully exit a mortgage that you can no longer afford.

Stay in control of your moving date

When your home is foreclosed, you legally have three days to move after the deed is recorded. If foreclosed, you have limited time to move from your former home. Making things worse, the bank may postpone the sale of your home repeatedly. This can leave your life in constant upheaval as you never know when you will have to move. As a result, many homeowners simply avoid the stress and move early. They would rather abandon their home than than worry about when they will have to move.

With a short sale, you know when your house will be sold, and when you will need to move by. You can eliminate the fear and uncertainty that comes with a foreclosure.

Potentially receive relocation assistance

Many lenders and banks offer relocation assistance with a short sale. This can amount to several thousand dollars in cash back to you upon the sale of your home. Even if your home is upside down, you may still be able to receive money with the sale of your home.

Why would a bank do this, you ask? Because it is expensive for a bank to foreclose. It is also much easier for the bank to agree to sell your house at a loss, than to navigate the legal maze of foreclosure.

Able to buy another home sooner

With a foreclosure, you typically need to wait seven years before you will be able to qualify for another home loan. By doing a short sale, you can often qualify for a loan to purchase another home within two years. Some lenders even allow you to buy a new home while your previous home is being sold as a short sale!

The key to short selling and still being able to buy another house:

- You made all mortgage payments during the last 12 months of the loan in the months they were due

- You made any installment payments for the same period during the months they were due

Relief from constant phone calls from the bank

When you get behind in your mortgage payments, your phone starts ringing with calls from your lender. It’s embarrassing. You want to pay, but you just don’t have the money. Trying to work with your lender when emotions are high is difficult. With a short sale, an experienced real estate agent will stop the phone calls, pauses the foreclosure process, and handle the conversations with the bank for you. You can avoid those emotionally difficult phone calls and emails.

Eliminate or reduce additional liens

Some homeowners may have additional loans such a second mortgage or a Home Equity Line of Credit. Generally speaking, these loans are not eliminated when your home is foreclosed.

California has a one action rule. Basically this means that your mortgage company can either pursue taking back your house or your money. This means that the lender who forecloses on your mortgage cannot sue you for any money they lose. However, this only applies to the lender who forecloses. Any other lender will be left with the right to sue for their losses. Even though you no longer own your house, these lenders can still pursue you for payment.

A good short sale negotiator will include all of your mortgages in the negotiation process, either eliminating or reducing the amount owed. Typically, your second mortgage lender will accept a substantial discount as long as they are paid from the proceeds of the sale of your home. You can potentially eliminate years of additional debt following you by negotiating it away with your short sale.

Why you need to start your short sale soon

Lisa Welsh a short sale expert in Rocklin, California with hundreds of successful negotiations offers the following advice.

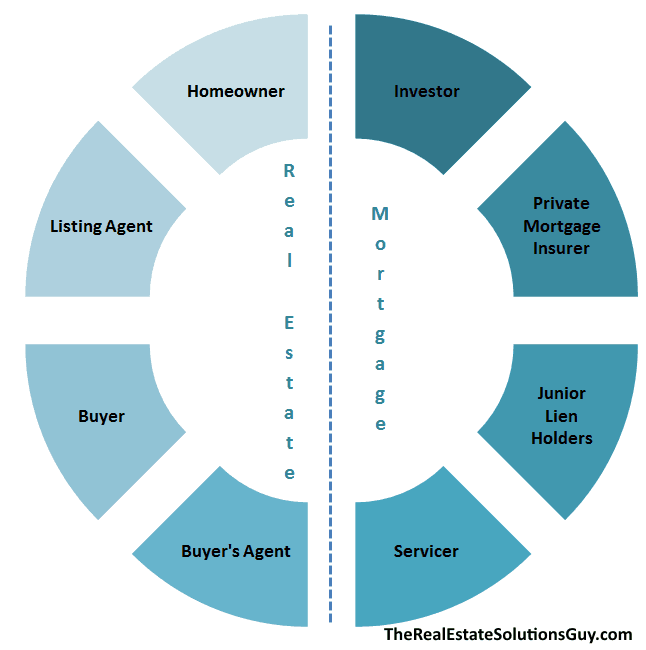

Parties involved in a short sale negotiation

There are many parties involved in negotiating paying a reduced amount in your loan. You’re familiar with the parties on the real estate side. But what about the parties on the mortgage side?

Investors

Most people are only familiar with the parties on the left. However, there are several people involved in your loan. You may have gone to your local bank to obtain your home loan. But banks don’t usually make their money lending their own money. They make their money by originating loans (creating new loans) and then selling those loans to investors. The investor will typically be a Wall Street company or a government entity such as Fannie Mae.

Private Mortgage Insurer

Investors may feel that certain borrower are a risk, such as when they have a low down payment. When this occurs, the investor will require insurance in case the borrower defaults. Private Mortgage Insurance or PMI is a type of insurance that protects the investor from default by guaranteeing your loan. If you default on your loan, the private mortgage insurer pays the investor for their losses.

Junior Lien Holders

Do you have a Home Equity Line of Credit or have more than one mortgage? If so, you have Junior Lien holders. In addition to mortgages, junior lien holders include anyone who has recorded a lien against your name in public records. This includes unpaid alimony, child support and IRS tax liens. Anyone who has filed a lien against the borrower in public records, will need to be negotiated with during your short sale.

Servicer

You may have gotten a notice saying that your servicer had changed. This often occurs when your loan is sold to a different investor. A servicer is a company that collects payments for the investor and distributes any funds for insurance and property taxes if necessary. The servicer acts as an intermediary between the borrower and the actual investor.

During a short sale negotiation all of these parties must be contacted and negotiate any settlements. This is why a short sale can take so long to complete and why you need an experienced real estate agent on your side.

How a short sale works

At first, a short sale looks very much like the normal process of selling your home using a Realtor®. Most lenders will require that you use a real estate agent to sell your home to prevent any possible fraud. Your lender will want to make sure they get the best price for your home, and that the bank doesn’t lose any more money than necessary. Your agent will advertise the home for sale looking for the best buyer who will purchase your home quickly, keeping you from foreclosure.

Once you have a signed contract with a buyer, your agent will begin the long process of negotiating and convincing your lender of the need to do a short sale. This process can take between two and six months, depending upon your lender.

During the negotiation, your agent will help you assemble a short sale packet. They will use this to explain to your lender why a short sale is needed. Your agent will also be working to help you get relocation funds to help you move.

The importance of using an experienced short sale agent

It’s important that you use a real estate agent that is very experienced in short sale negotiations. It takes more than just a few short sales for an agent to master everything it takes to keep your home from going to auction. An experienced short sale agent will be in constant contact with your bank making sure your home doesn’t go to auction. We’ve seen agents miss staying on top of the short sale process, only to have their clients house sold at auction instead of completing the short sale.

Your Short Sale Packet

As mentioned before, your short sale packet will be the evidence your agent uses to explain to your lender why you need to do a short sale. Your agent will help you with this, but ultimately you will need to put this packet together yourself.

Items to include in short sale packet

A hardship letter

Your hardship letter is a personal letter from the borrower(s) explaining why you’re asking your lender to accept a short sale. Maybe you’ve lost your job and need to move out of state for another job. You could have a disability that has caused you to be under employed. It could be that your spouse has passed away and you no longer have the income to maintain the mortgage.

Welsh continues and says, “Explain your situation, but keep it short. Bullet points with dates are better than long paragraphs”. You want to let your lender know that this is not a short term problem that will get better. You may also need to describe any expensive repairs in your house that you are unable to perform.

Financial statements

Every person who has signed for your loan will need to provide copies of their financial statements to your lender. This will include copies of the previous two years tax returns and a signed IRS 4506T allowing your lender to receive copies of your tax records from the IRS. You will also need the most recent three months pay stubs, and copies of your previous three months bank statements. Welsh suggests you also include any award letters such as child support or alimony payments.

Lenders are notorious for misplacing these documents after you have sent them. It’s beneficial to keep an electronic copy of these documents in a folder on your computer where you can resend them easily. A good Realtor® will keep a copy of these as well, so they can respond quickly to your lender’s requests for documents.

Don’t try to fudge the truth and hide assets. Falsifying statements to your lender is a federal crime and pursued by the FBI. Besides, if your lender thinks you’re hiding something, they will reject your short sale.

Signed purchase contract

Most lenders will not even begin a short sale negotiation until you have a signed purchase contract. When your lender receives your purchase contract they will perform an appraisal of your home to determine what your home is worth and if a short sale is needed.

Lender specific forms

Every lender will have their own bank specific forms. Your real estate agent will be able to obtain these from the bank’s short sale negotiator for you to complete.

What happens now

First of all, keep paying your HOA and city utilities. These are non negotiable, even if you cannot pay your mortgage. Even if you lose your home to foreclosure, these bills will continue to follow you until paid.

After reviewing your short sale packet, your lender may ask for more documentation from you. This is not unusual. An experienced agent will have already contacted your lenders to determine what additional documents they require for a short sale before you begin. Your lender may also counter the price in your purchase contract. You buyer can then either accept, counter or reject the banks offer.

A short sale is not for everyone. Most buyers aren’t prepared for the long negotiation process with the bank. You need an experienced agent who will stay on top of the bank to keep you from foreclosure. You also need a buyer who understands the short sale process and will not cancel your purchase agreement two months into the process because it takes too long.

Looking for a committed short sale buyer with a team of experienced agents?

The Real Estate Solutions Guy is here to help. Fill in the form below to get started.