-

- Homes listed for sale are seeing more price reductions

- If you plan on selling your home in the next year, prioritize your home repairs by health and safety first

- Focus on your home’s appeal, not expensive upgrades -expensive upgrades are not likely to pay for themselves

- Sellers should anticipate banks tightening their lending policies, further reducing the number of potential buyers

Get an as-is cash offer for your home

"*" indicates required fields

Selling your home is never an easy process. Selling your home during a recession can be even more stressful. While not everyone agrees, more and more economists are saying a recession is likely in the near future. Interest rates are already affecting home sales, and are likely to continue to have a greater impact.

Doug Duncan, the Chief Economist with Fannie Mae in a July press release says, “we currently anticipate that it’ll [coming recession] will begin in the first quarter of 2023, slightly earlier than we previously predicted.” Not only is the economy headed for a reversal, but home prices are facing a downturn as well. “Homes listed for sale are increasingly seeing asking-price reductions” says Duncan. He continues, “Both existing and new [homes sales] – are slowing.”

Where the housing downturn is most painful

The downturn is more painful in the “pandemic buying boomtowns” like Boise, ID which saw a 69.7% of sellers drop their price in July. Sacramento, California, saw a rush of buyers from the Bay Area during the pandemic as remote work opportunities allowed them to buy more “affordable” homes. Now, Sacramento is in the top 5 fastest cooling markets in the nation according to a report by Redfin, preceded only by San Jose, Oakland and San Francisco.

You don’t always have a choice as to when you need to sell your home

They say “timing is everything”. However, not everyone has the luxury of choosing when they need to sell their home. However, life happens, job locations change as well as financial needs. If you’re not in a situation where you need to sell, waiting things out a few years may be an option. But what if you if you don’t have that luxury and know you will need to sell your home in the coming year? What should you be doing now?

Preparation tips for selling your home during a housing recession

If you anticipate needing to sell during the next 18 months, there are things you can do now. The most important is making a plan and following your plan.

Bill Samuel, a real estate broker and owner of Blue Ladder Development in Chicago, suggest one start by becoming familiar with the current homes for sale. “Start by getting familiar with the inventory in your area by visiting homes listed on the market now. Be sure to take notes of what you see during your tour so that you can look back at them next year when you are ready to list. Since you aren’t planning on selling until next year, you’ll be able to see what happens to the homes listed for sale.”

Separate health and safety versus other repairs

Next, begin making a list of repairs that need to be done. An easy way to decide if a repair would be nice or if it really needs to be done is to ask yourself, “Is this a health and safety issue?”. Health and safety issues will be called out during any home inspection. Knowing what those items are will help you budget and shop for affordable contractors before you need to sell.

If the stairs going up to your deck aren’t safe, they probably need to be repaired. If your roof leaks, it needs repaired. However, if your old sprinkler system isn’t working and the lawn is dead, it doesn’t need repaired.

Obtain a Home Inspection

If you aren’t sure if there are any health and safety issues, consider paying for a home inspection. Home inspections typically run around $400 to $500. While a bit pricey, they can give you a clear list of things you may want to repair prior to placing your home on the market. In addition, you can provide the report to potential buyers and identify the items you have already corrected, potentially easing buyers’ concerns.

Order a Pest Report

Most Realtors® will have their buyers order a pest inspection as part of their due diligence. The pest inspector looks for evidence of termites, but also for wood destroying fungus or “dry rot”. Your pest report will classify the findings as either Section 1 or Section 2. Section 1 items would be termites and dry rot, where Section 2 items might be a leaky faucet, or a loose toilet tank. Many section 2 items are things either the homeowner or a handyman can easily repair. Section 1 items can be more expensive and may require specialized contractors.

Start de cluttering

Real estate agents always tell their clients that clutter free homes sell faster. Cliff Auerswald President of All Reverse Mortgage, says, “The more stuff you have in your home, the harder it will be for buyers to see its potential. Start getting rid of things that you don’t need and put them into storage if necessary.” Clutter free houses not only look cleaner, they look larger.

Don’t waste your money on expensive upgrades

You may be thinking you need to make a lot of expensive upgrades to sell your home. Maybe your thinking you need a new kitchen or you need to remodel your bathroom. The truth is, that there is no single renovation that increases your home’s value by more than what it costs for the renovation. While renovation projects may increase your home’s appeal, the return on your investment is generally less than the dollars you spend.

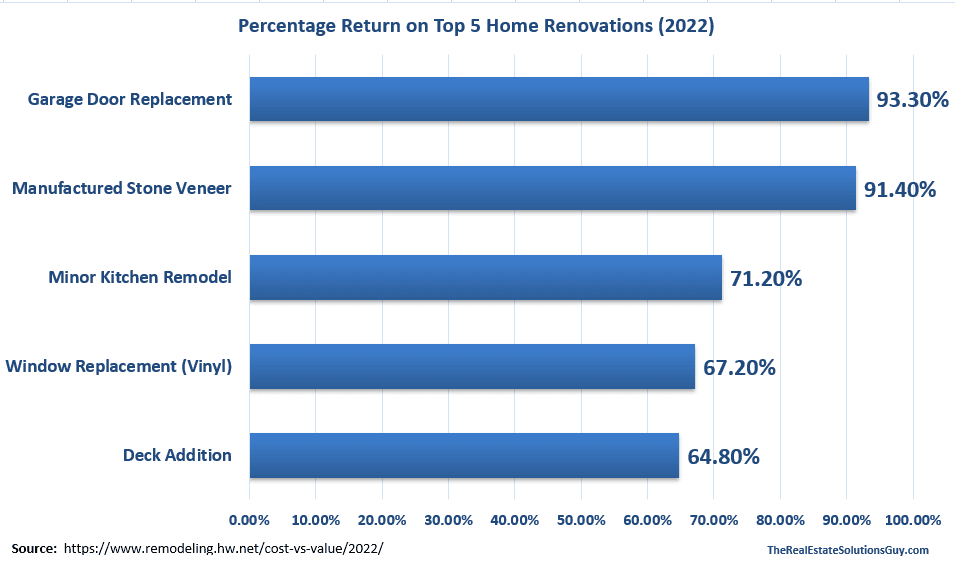

For example, many people and Realtors® assume that remodeling your kitchen will increase the home’s value dollar for dollar. However, according to an annual survey conducted by Remodeling Magazine, even a minor kitchen remodel only returns 71% of the money you spend on the renovation.

So let’s assume your home is a worth $300,000 and you want to spend $20,000 on a new kitchen. After the kitchen remodel, your home’s value will only increase by $14,200. And the percentage has actually declined steadily over they past 5 years.

When you look at the top 5 highest return on home repairs, none of them return 100% of your investment.

Remodel versus repair

Rather than doing expensive remodeling, ask “What can I repair?” If a kitchen remodel costs $15,000 for cabinets and new appliances, consider freshening up your kitchen with new counter tops instead. Granite, quartz and Silestone are popular and can often be installed for under $3,000.

Increased value versus increased appeal – choosing the right renovations

It’s important to focus on the aesthetics of your home, rather than renovations you have dreamed about. Chuck Vander Stelt, a Realtor® in Valparaiso Indiana says, “focus on the little things which make a home look more expensive”. Vander Stelt says you should, “replace [upgrade] your contractor grade bathroom vanities, and change out your light fixtures and interior door handles.”

Megan Micco a Realtor® in the greater San San Francisco area agrees. Micco says, invest in “updates that will improve the general aesthetics of the property to generate as much buyer interest as possible. This includes things like interior and exterior painting, light remodeling (new countertops or refinished wood floors), and most importantly, high quality staging.”

There are some exceptions of course. If your entire home is beautifully updated with the exception of the kitchen or master bathroom, they may be worth upgrading. You probably won’t get your money back directly. However, you may just be removing the one thing that would turn potential buyers off. Remember, focus on appeal.

What to expect if selling your home during a recession

Fewer buyers, but more negotiation

Fewer buyers and longer time on the market are to be expected during a recession. But sellers may also experience tougher negotiations from buyers, especially if their home needs repairs. During a recession, buyers have expanded inventory of homes to choose from, and can be more particular in their priorities. If your home needs lots of repairs, you may find any potential buyers making low ball offers.

Lending may have tighter restrictions

Lending requirements are constantly changing. When the economy tightens, so do the banks’ lending policies. When the economy is moving along, their lending policies are more loose. Auerswal says that during a recession, “banks may be more hesitant to approve mortgages.” The challenge he continues is that this can “reduce the pool of potential buyers”. This was very evident during the Great Recession, where well qualified buyers often found it difficult to obtain home loans because of tighter lending policies.

More contingent offers

When a buyer writes an offer to purchase your home, there may be contingencies are part of the offer. Micco describes contingencies as “conditions under which the buyer can cancel a contract to purchase your home”. Most of the time, these contingencies are things like reviewing the pest and home inspection reports. However, in a slow real estate market, you can expect an increased number of contingencies. These contingencies might be a mortgage interest rate that is acceptable to the buyer, or the ability for the buyer to sell their current home.

Related Article: How to Work with Your Realtor® to Get What you Want

Lessons from previous recessions

The good news, is that recessions don’t last forever and the buyers will return. There’s still a limited housing supply in many parts of the country and there’s pent up demand. The first areas to see movement will often be in nicer entry level neighborhoods and move up neighborhoods. These owners typically have some equity and will want to take advantage of the lower prices in other nicer neighborhoods. This often increases affordable inventory to first time home buyers in the entry level market.

Clean and maintained homes in desirable neighborhoods still sell

We were buying and selling homes in the California Central Valley during the Great Recession. Even during what was difficult economic times, nice houses still sold. Homes in nicer, family friendly neighborhoods, sold more quickly that some of the tougher neighborhoods. But even homes in rough neighborhoods still sold.

If your homes is clean and maintained, with the right agent, your house will still sell.

Conclusion

One of the mistakes many sellers made during the Great Recession was having unrealistic expectations. The housing market was sliding downward fast, but sellers were trying to sell their home for what their neighbor sold their home for a year earlier. Instead of being ahead of the market, many sellers and real estate agents lagged behind it.

While it’s extremely unlikely we will see anything like the Great Recession in 2023, the lesson are the same. Be realistic and price your home right. Make those health and safety repairs your inspection reports identified before you need to sell. And fix the Section 1 areas of the pest report.

When choosing an agent, don’t just choose an agent who promises you the highest price – they may simply be desperate for your business. And don’t go with the agent with the lowest price – they may simply want a quick sales commission. Instead, start with our Top 10 Questions to ask your Realtor® before hiring them, and interview several agents. Having a great real estate agent who has experience selling during a housing recession will be invaluable.