Update: When I originally wrote this article back at the beginning of 2017, I was primarily focused on HELOC loans resetting. Since then, I’ve been paying closer attention to the types of home loans sold at foreclosure sales this year. What I discovered is that there are still many Adjustable Rate Mortgages (ARMs) types of loans resetting as well. Many of these people still need to be able to stop the foreclosure of their home, but aren’t aware of their options.

Four out of every 10 homeowners took out a home equity line of credit prior to the housing bust.

Now those lines of credit are coming due and borrowers are seeing their monthly payments spike

During the housing boom of 2004-2009 many homeowners took out equity lines of credit on their homes. Banks loved to issue lines of credit to homeowners. It seemed like every one you talked to was taking money out of their lines of credit. Even after the housing bust, you still see advertisements like “Got high credit card debt? Reduce you payments with a home equity loan”. All the way up through the house bust, banks were pushing home equity lines of credit to their customers.

Banks were Giving Money Away – “I didn’t even have to ask”

In an article that appeared in the LA Times, Richard Peterson describes how the banks were giving money away.

A year before the housing meltdown, Richard Peterson took out a $167,000 credit line on his Huntington Beach condo. He didn’t even have to ask. The lender, Countrywide, called him on the phone in 2006 and offered him one.

“They were just giving money out,” Peterson said. “It paid off my car and everything.”

Home loans resetting interest rates

Borrowers were given loans based on the equity in their home while only having to pay a nominal initial interest-only payment. This initial payment did not pay down any of the principal balance on the loan, but was simply an interest payment. These were similar to many of the “creative loans” during the housing boom where initial payments were teaser rate loans. These payments were interest only for a set number of years. After the teaser rate ended, the loans went to fully amortized loans with much higher payments causing many people to lose their homes.

Home Equity Lines of Credit (HELOCs) work very similar. During the initial years known as the “draw” borrowers can borrow up to the full amount of the line of credit. During the draw period borrowers are only required to pay interest on the amount borrowed. This draw period typically lasts for 10 years.

After the draw period ends, the line of credit resets to a fully amortized loan. This event is known as the reset. After the reset, the borrower continues to pay the interest on the loan. However, now they must also start paying back the principle balance to the bank. This pay down process is known as amortization. Typically equity lines of credit convert to 20 year amortizing loans after the reset. This means that remaining balance must be paid off over 20 years in equal payments.

What many borrowers fail to realize is that once their equity line of credit resets, monthly payments become a fixed amount every month.

Home Loan Resetting Payment Shock

Mr. Peterson had an unpleasant shock when he received a letter from his loan servicing company stating that his monthly payment was going to rise from the $400 a month he was paying to more than $1,000 a month after his loan reset.

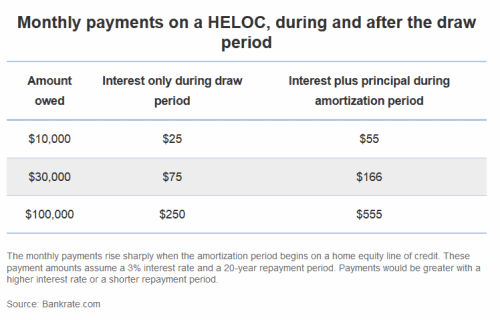

One doesn’t have to borrow $167,000 to see a large jump in their payment when their loan resets. The following image from Bankrate.com shows how various amounts owed on a HELOC can jump when the draw period ends. A loan for $100,000 can more than double after the reset period and many homeowners find themselves in similar situations as Mr. Peterson.

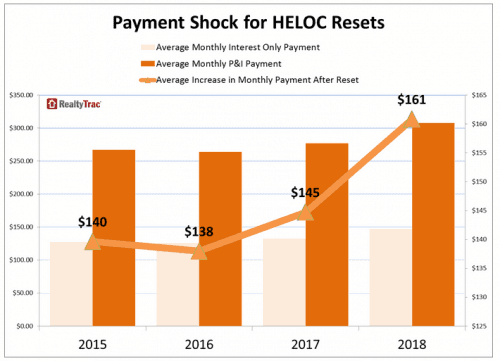

Payment shock could be even higher in 2017

According to RealtyTrac, resets will continue to be a problem in 2017 with a significant increase in payment shock in 2017 and 2018. Just this past December, the Fed announced increased interest rates and indicated future hikes for 2017 were likely. Some members of the Fed are itching for even faster interest rate increases. All of these hikes will likely lead to increased payments for those still making interest only payments. But for those with resets coming up, they will have even larger payments.

National mortgage payment increase amount – Source RealtyTrac.com

What are your options if you have a mortgage loan about to reset?

Fortunately, home prices have significantly risen during the past few years. Far fewer homes are underwater, though some are given the slower home price appreciation of the past year or two. Though inventory is still low, buyers seem to reaching a price ceiling that they are willing to pay. If you have an equity line of credit that you took out in 2006 to 2008, your bank is probably already sending you notifications. Banks are being proactive in preventing defaults and are probably giving you multiple options. It not, here are some things to consider. If you are in good financial shape you might consider the following options:

1. Refinance both your primary home loan and your HELOC into a single loan.

If you didn’t take advantage of the amazingly low interest rates the past few years, it may make senses to take advantage of low rates now. Consider refinancing both loans now and combine both your primary home loan and your HELOC into a single loan. However, if you already did take advantage of those low interest rates it probably does not make sense to increase your home loan interest rate. In which case, you would not want to combine your home loan with your home equity line of credit and lose your great interest rate.

2. Refinance just your HELOC

Some banks are offering to simply refinance your existing line of credit. Depending upon your financial situation and your home’s value, they may be willing to create a new home equity line of credit. This would again be an interest only loan, with a set draw period, that would convert to an amortizing loan after a period of time. Remember, if you originally promised yourself that you would pay down your equity line of credit and haven’t, you may simply be repeating the same mistake. If it make sense for you to keep an interest only loan and and your existing lender isn’t willing to consider this – shop around, you may find other banks who are willing or even have cheaper interest rates.

3. Convert your line of credit to conventional amortizing loan

Sooner or later, unless you intend to sell your house in the very near future, you or your heirs will have to pay back the loan. Talk to your lender about converting your loan to a fully amortized loan where you can afford the payments. Before you do, sell some stuff and pay down your existing principle. The less principle balance you have when you start your new amortizing loan, the lower your monthly payments will be. Once an amortizing loan is set, the monthly payments won’t do down even if you pay extra on the principle later.

4. Consider selling your home

Since so many homes have risen in value, you might want to consider simply selling your home. Selling your home would allow you to pay off all of your debt and still buy another home. If you have taken reasonable care of your home and spent the majority of your equity line of credit on home improvements, your home can probably sell for top dollar. If you have a little money for upgrades, even simple upgrades can more than pay for themselves in selling price and time. For many people this is a great solution that allows them to pay off their equity line of credit and still have some money left over to purchase a new home. Contact a qualified local real estate agent who has your best interest at heart.

If your home needs lots of repairs and you don’t have the time or the money to make the repairs, you may need to contact a buyer who won’t be using a bank loan to buy your house. Most banks are particular about what kind of houses they will loan money for and don’t want to lend on fixer uppers or houses that need significant repairs. There’s lots of “investors” who put up signs for “We Buy Houses AS-IS” but be careful. Many of these so called “investors” simply took an expensive seminar over the weekend and may not be able to finish what they start. Consider The Real Estate Solutions Guy if you are thinking of selling a property in need of repairs.

For seriously underwater homeowners, there are fewer optimal choices.

The less optimal choices are : default and foreclosure, mortgage modification or a short sale. Each of these have a down side, but may also provide a solution if your home is seriously underwater.

Foreclosures will stay on your financial record for 7 years. In addition any future loan applications you complete will ask if you have ever had a foreclosure in the past that is not on your credit report. To say “no” is considered bank fraud and a federal crime so don’t let people tell you that everything simply goes away after seven years.

Mortgage modifications are better, but banks don’t have the same motivations they did during the housing bust. Then the banks were afraid they might end up with a house worth less than the loan if the foreclosed and they would lose money. With rising home values, most lenders see your home as a safe bet should they need to foreclose.

Short sales have declined significantly, but still exist. You will need an agent experienced with negotiating short sales to make this option work successfully. Always make sure to ask a potential real estate agent how may short sales they have personally negotiated. Many agents hire someone else in the office to negotiate short sales and are not personally qualified to negotiate your short sale. Given the complexity of short sales and potentially long time frames to close, many end user buyers are not willing to attempt to purchase short sale properties. This is where a local investor can be a big help.