Get an as-is cash offer for your home

"*" indicates required fields

House fires are traumatic. Even after the fire is out, your emotions may still be pumping when you think about it. But how do you move forward with repairs and insurance? What’s the next step you need to take with your fire damaged home.

In this article, we provide a clear path toward rebuilding after a house fire. To help with the process, we asked several industry experts. We asked a fireman, an insurance representative and a home inspector the following question. What should homeowners do if their home has been damaged in a house fire?

After a House fire- what should I do now?

Matt Albrecht is the President of the South Portland Professional Firefighters union. He says the first phone call you should make after a fire, even if it’s out, is to your local fire department. The fire department “will have a long list of resources they can contact on your behalf” Albrecht says. He continues, “you’re likely to get a faster response if the fire department contacts these services” than if you were to contact these services yourself.

Most important, the fire department will complete a damage assessment report. This report will document the cause of the fire, as well as potential costs to repair any damage. We’ll talk about this report in a moment as you will need it for your insurance and contractors.

Lastly, if you haven’t called your insurance carrier, do so. Your insurance company has experience dealing with house fires. Most importantly, they will probably send a fire remediation company to your home within hours to begin work.

What is a fire damage assessment report?

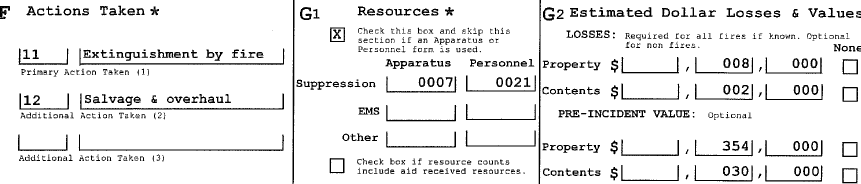

The assessment report, written by the fire department, comprehensively details the cause of the house fire. According to Albrecht, these “reports are federally mandated and all contain similar information”. Additionally, it will include an estimate of losses both to the home and of personal property. Using this report, you can systematically estimate what areas need replaced or repaired, as well as how much it may cost.

Maybe most important, Albrecht says this report report will be crucial in working with your insurance company.

Fire Damage Assessment Report Excerpt

Should you repair or sell your fire damaged house?

In most cases, fire damaged houses can be repaired successfully. Albrecht says “in many cases, you will find the insurance will cover most, or all of the costs. In this case, it’s much better to repair. You may be able to make modifications that make you appreciate the house that much more, and not even want to sell it”.

However, don’t expect your insurer to pay for home or building code upgrades. For instance, if you had a kitchen with basic appliances you bought at the big box stores, your insurance company probably won’t pay for an expensive new Wolff SubZero refrigerator. This will have to come out of your own pocket.

Your local building department may also insist that you upgrade the areas being repaired to current building codes. Depending on where you live, this could include some expensive items such as fire sprinklers or solar panels. If your insurance policy doesn’t provide building code upgrade costs, you may have to pay for these building code upgrades out of pocket as well.

Disclosing previous fires to future buyers

Keep in mind, that you’ll need to disclose to future buyers that your home had a fire. Don’t forget to carfully document all of the work that was performed, and by whom. You will need to disclose and provide this documentation when you sell your home. If you don’t disclose the fire, it’s likely to be called out during your buyer’s home inspections.

Arie Van Tuijl, a home inspector and founder of Home Inspector Secrets says he looks for signs of previous fires during home inspections. Tuijl looks for wood that is painted over than normally wouldn’t be, like roof sheeting or ceiling joists in the attic or garage. He then takes pictures of these suspicious areas and reports them to the buyers.

We buy fire damaged houses

Not everyone who owns a house with fire damage will want to repair it. If you don’t have fire insurance to pay for the damage, or you would rather take the insurance money and sell the house as is, there are companies that buy fire damaged houses. These companies are often contractors or real estate flippers who buy fire damaged homes and restore them. To be sure, you won’t get as much money as you would by fixing it up yourself. But if you don’t have the money to make the repairs, or need the money for something else, these companies offer an alternative way to sell a fire damaged home.

Does previous fire history impact the home’s future insurance rates?

Generally, a single insurance claim will not make your insurance rates increase, but this is highly dependent on your insurer. Melanie Musson, a home insurance specialist with USInsuranceAgents.com says “with some companies, you may see higher rates, and with others, you may not. If, however, you also recently made a claim for water damage and made another liability claim a couple of years ago, you can count on your rates going up. The more claims you make, the more risk you present to the insurance company, and the higher your rates will rise.”

How do you negotiate with your insurance company?

This is when you’ll definitely want a copy of the fire department’s damage assessment report. Along with your report, you’ll also want estimates from at least two contractors for repairs, preferably three.

Keep in mind that insurance adjusters work for the insurer, not you. Insurance companies rely on the adjuster to control costs, while identifying needed repairs. As a result, you can expect to spend a lot of time arguing over the scope of work and the value of damaged items. Musson says, “It may feel like a full-time job, but it’s time well spent”. She adds, “Be sure you provide documentation of each damaged item and be prepared to argue for why something needs to be replaced or repaired”.

Tip: Keep receipts and documentation for home upgrades or major appliance purchases in a fire safe location. Then, if you need to argue why the insurance company should pay for that expensive cooktop you bought last year, you’ll have documentation. If the adjuster is being unreasonable, consider reaching out to your state’s department of insurance for further help. Nothing gets an adjuster’s attention faster than a letter from the state’s insurance commissioner.

What kind of damage can you expect?

Smoke and water often cause the most damage in house fires. You should assume water has reached almost everywhere, and has the potential for growing mold. However, fire restoration companies can mitigate some of the mold potential by getting in early after the fire and removing as much moisture as possible.

What the water doesn’t damage, the heat and smoke will. It’s amazing how far toxic smoke can penetrate in your home. Musson says “your shower may look untouched by the fire. But the heat of the fire allows the smoke and accompanying chemicals to enter the plastic of the shower walls”. Then later, she adds, “when you take a shower, the heat allows the plastic to release the chemicals back into the air”.

Do I need to worry about toxic cleanup?

One major factor that most homeowners do not think about after a house fire is toxic cleanup. Don’t risk your health. Leave toxic cleanup to licensed professionals. Licensed removal companies can inspect your home, and identify things requiring removal or decontamination in your home. You may also find it to your advantage to find companies that only perform testing for toxic contamination. These companies can help you independently define the scope of work. Once you know what needs to be done, you can avoid companies trying to pad their profit margins by adding unnecessary work.

Don’t under estimate the cost. Hazardous material cleanup of fire damage is big business. Even small jobs can be very expensive. Expenses can run several thousand dollars even for something like a small kitchen fire. To protect yourself from over paying, you’ll want to obtain estimates from multiple toxic removal contractors.

Conclusion

If you haven’t asked for a copy of the fire damage assessment report, or called your insurance agent, now is a good time to do so. Remember, you’ll use this report both for insurance purposes, as well as for obtaining bids from contractors. If you don’t have fire insurance and want to sell your fire damaged home, you can sell your home to companies that buy fire damaged houses.

Lastly, if you are reading this and haven’t experienced a fire in your home, now would be a good time to use your cellphone. Walk through your home to take pictures or a video of your home. Take pictures of any special features as well as any valuables for your documentation.